i haven t filed taxes in 10 years what do i do

You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure to file timely. Owe IRS 10K-110K Back Taxes Check Eligibility.

Top 10 Places To Do Your Taxes Online Tax Refund Tax Preparation Paying Taxes

If you dont file your taxes on time the IRS can impose penalties and charge interest.

. You are only required to file a tax return if you meet specific requirements in a given tax year. No Tax Knowledge Needed. The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns.

And if you did not file a 2019 return you will have trouble e-filing. You can only claim refunds for returns filed within three years of the. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

Well determine the amount of years that need to be filed. Short and Long Term Consequences of Not Filing for Ten Years There are several things you may need over the course of your life that require you to show tax returns. Ad Find Out Why Precision Tax Gets The Highest Customer Ratings For IRS Tax Help.

Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years. Tax not paid in full by the original due date of the return. Make a determination order records and file the returns.

Overview of Basic IRS filing requirements. More 5-Star Reviews Than Any Other Tax Relief Firm. In most cases the IRS requires you to go back and file your.

Havent filed taxes in 10 years but paid in alotwhat to do. Log in or sign up to leave a comment. All of the IRS records will be faxed to our office or well.

Capture Your W-2 In A Snap And File Your Tax Returns With Ease. Ad Owe back tax 10K-200K. It is not until you actually do file a return that the audit time limit -- three years -- and collection time limit -- ten years -- starts to run.

The current online program can only be used for a 2020 return--no other year. Ad Free tax support and direct deposit. To file a tax return for a past year.

If you owed taxes for the years you havent filed the IRS has not forgotten. As a practical matter however if you havent heard from. Penalty for filing late 5 of your unpaid taxes for each month that your return is late.

The IRS doesnt pay old refunds. If you have unfiled returns for multiple years you should first get a copy of your IRS account transcripts which will show what returns havent been filed and what actions the. If you have unfiled returns for multiple years you should first get a copy of your IRS account transcripts which will show what returns havent been filed and what actions the.

Ad Find Out Why Precision Tax Gets The Highest Customer Ratings For IRS Tax Help. For each return that is more than 60 days past its due date they will assess a 135 minimum. See if you Qualify for IRS Fresh Start Request Online.

Ad File Your IRS Tax Return for Free. More 5-Star Reviews Than Any Other Tax Relief Firm. Log In Sign Up.

Havent Filed Taxes in 10 Years.

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

These Tips From Personal Finance Expert Chris Hogan Can Save You A Lot Of Money When You File Taxes Filing Taxes Tax Season Personal Finance

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Income Exempted Income Tax Taxact Income

Topic 101 Irs Services Volunteer Tax Assistance Outreach Programs Education Savings Account Tax Help Irs Taxes

I Haven T Filed Taxes In 5 Years How Do I Start

Top 10 Places To Do Your Taxes Online One Can T Help But Feel Frustrated Knowing That Tax Day Is Just Around T Customer Service Fails Tax Time Ace Cash Express

How To File Taxes Cashnetusa Blog Filing Taxes Tax Help Tax Day

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

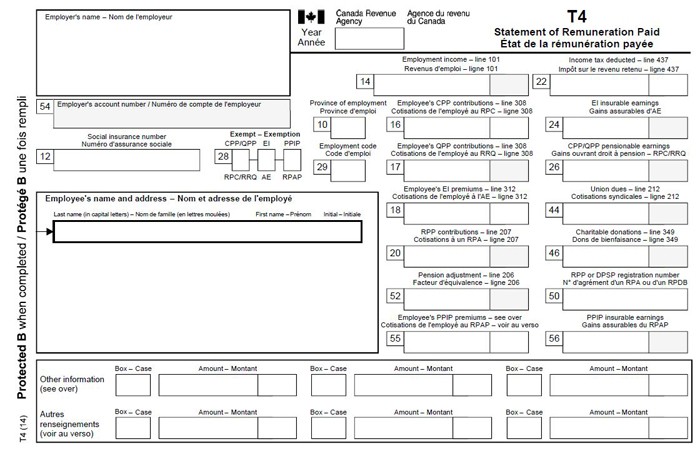

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

Find Out What To Do With A 1099 Form How To Include It With Your Personal Taxes And How To File This Type Of Income Tax Paying Taxes Income Income Tax Return

Anthony Bourdain Does Not Want To Owe Anybody Even A Single Dollar Wealthsimple Anthony Bourdain Anthony Financial

The Procrastinator S Guide To Filing Your Taxes At The Last Minute Procrastination Tax Guide

Waiting To File Your Taxes In 2021 Make More Money Business Finance Investing

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Consulting

Haven T Filed Taxes In Years What You Should Do Youtube

Tax Information Center Tax Tips H R Block Filing Taxes Income Tax Tax Day